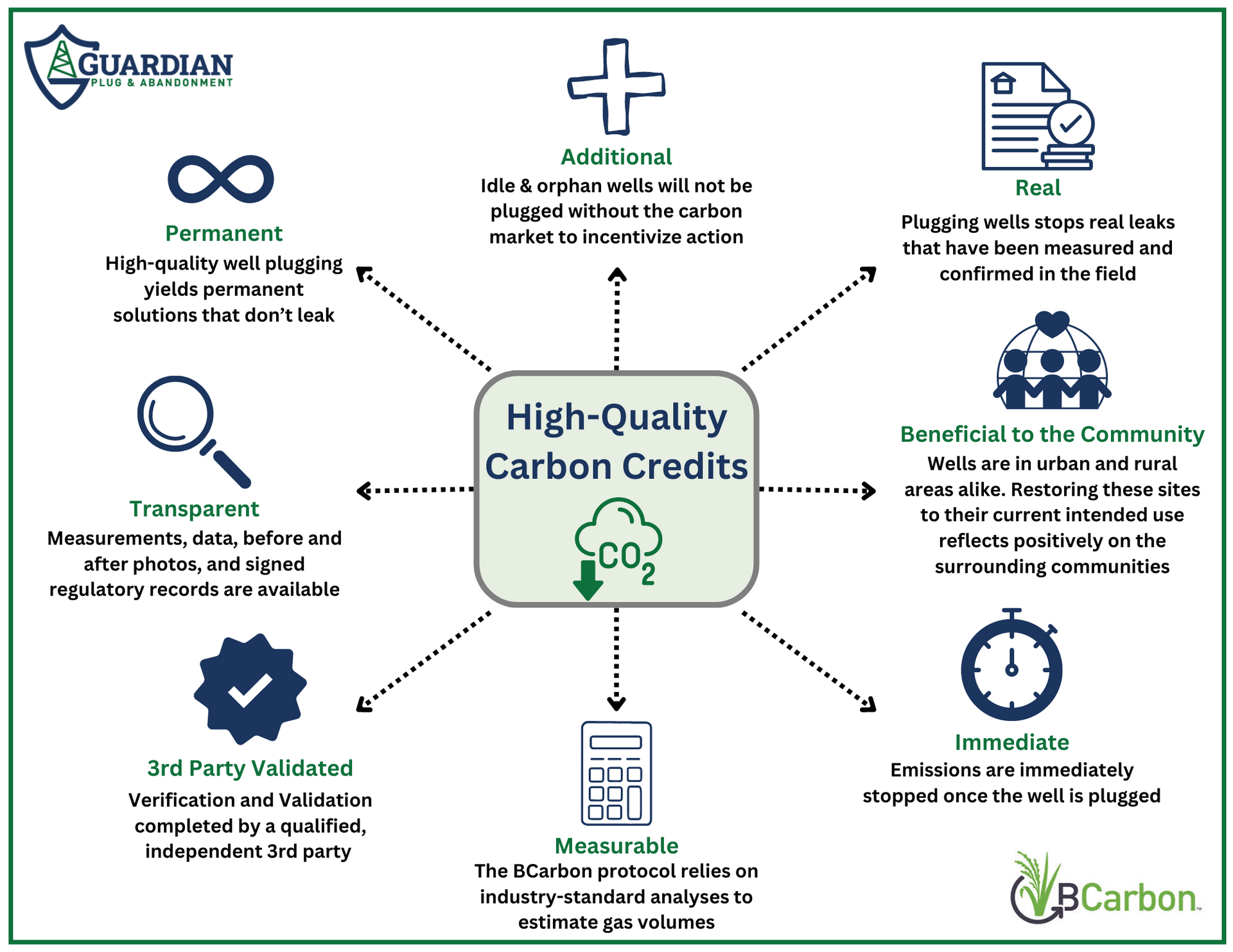

High-Quality Carbon Credits from Well Plugging

Carbon credits (also often called “offsets”) represent one ton of CO2 emissions reduced from the atmosphere. Companies buy these credits and retire them to offset their own annual carbon footprint, after reducing emissions as much as possible internally. In a perfect world, reducing a carbon footprint by one ton has the equivalent climate impact as buying one carbon credit. But is this true? Does one carbon credit actually equal one ton of carbon emissions reduced from the atmosphere? Before we answer these questions, lets take a look at one of the protocols for generating carbon credits from plugging and abandoning oil and gas wells.

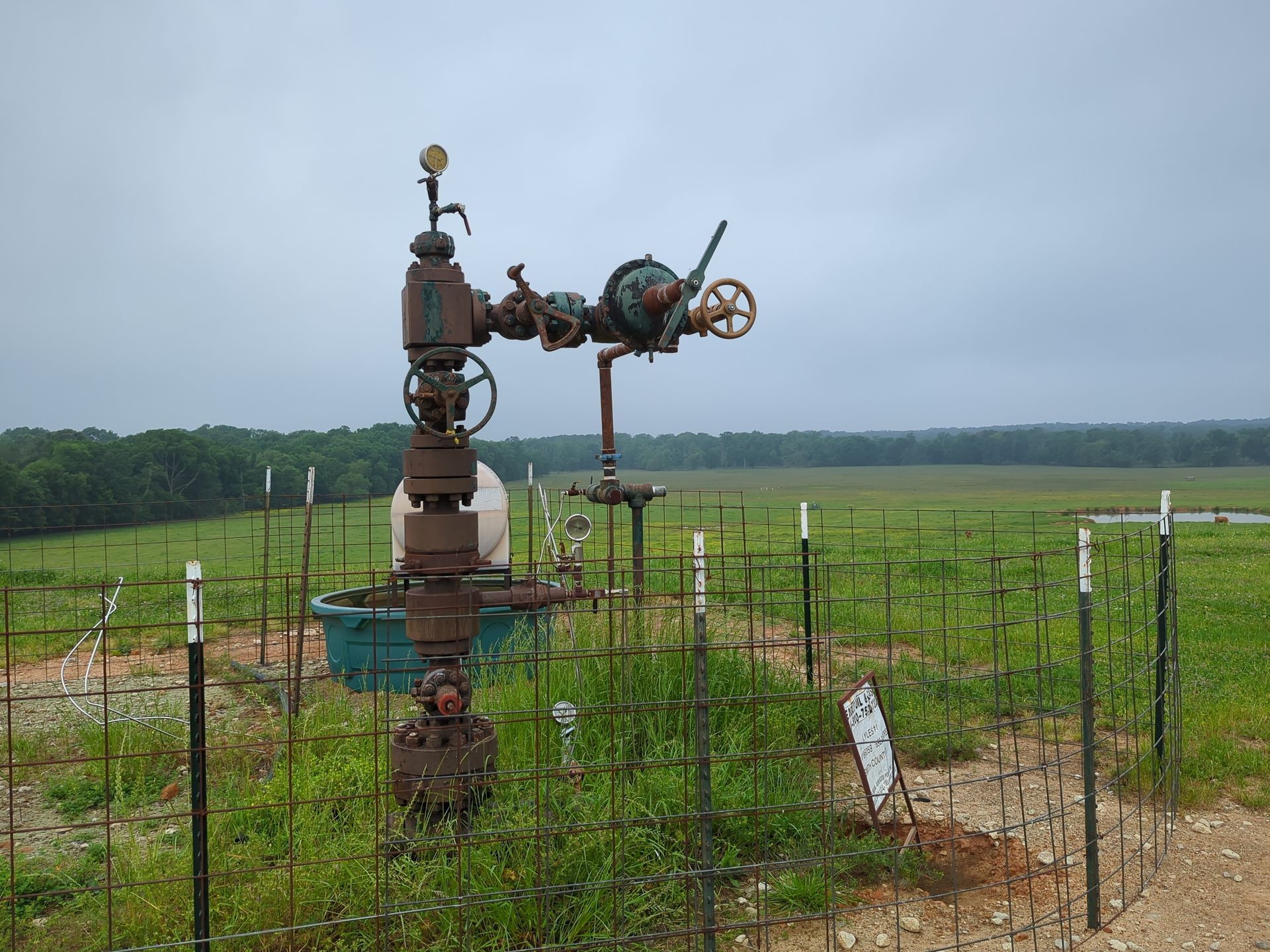

BCarbon is a not-for-profit carbon registry with a protocol titled “Methane Capture & Reclamation,” (MCR) which is focused on permanently plugging gas wells that are sitting idle, abandoned, and/or orphaned. The protocol entails finding methane-leaking wells and permanently plugging them, resulting in what is known as avoidance carbon credits, seeing that future emissions have been avoided. The amount of credits generated relies on historical production data to estimate the volume of methane gas that would have leaked over the next 20 years. The calculations use an industry-standard decline curve model and leak rate model to determine future gas leak volumes and subsequently methane tonnage. Methane is then converted into CO2-equivalent (CO2e) to determine the number of carbon credits each well generates. The protocol requires that the plugging plans and emissions calculations are verified and validated by a neutral third party before and after the wells are plugged. The project also is not complete

until 1) a post-plugging site assessment has determined that there are no more methane emissions and 2) the regulatory agency signs the plugging record stating that the well has been plugged in accordance with regulatory requirements. Finally, the protocol requires a site visit one year post-plugging to again confirm that there are no methane emissions.

Now that we have a basic understanding of BCarbon’s methodology for plugging wells for carbon credits, lets look at some of the key ingredients of a high-quality carbon credit and figure out how reliable these P&A-generated credits actually are.

Additional

Additionality is the idea that the positive climate action project would not have taken place without the carbon market to incentivize action. While operators are supposed to plug the wells that they drill when they are done producing, the reality is not so clear. In fact, the United States Environmental Protection Agency (USEPA) estimates that there are about 3.5 million abandoned wells across the USA (see here). BCarbon’s MCR protocol deems a well additional if “at the time of plugging, no person or entity has a firm, non-extendable legal obligation to plug it either (a) by law, regulation, statute, court order or other government requirement, or (b) by private contract.”

Real

For a carbon credit to be considered real it must represent an actual, verifiable reduction in emissions. The BCarbon protocol requires that actual evidence of emissions from each well are documented and measured. The calculations that determine the quantity of credits use the same scientific rigor that is used for SEC reporting for determining remaining gas in reserve. Finally, the work of plugging the well is signed off by a regulatory agency, demonstrating the realness of the work performed.

Permanent

Permanence in the carbon market refers to how long the carbon benefit from a project will last. High-quality well plugging consists of multiple 100+ foot cement plugs, (a) cast-iron bridge plug(s), and high-density kill fluid combined with pressure testing to ensure that the well is permanently sealed off.

Transparent

Transparency refers to having all the information and data available to interested parties. It also includes a public record and accounting of the credits generated, transacted, and retired. Abundant documentation and record-keeping are required as part of the MCR protocol, including project plans, photos, calculations, regulatory records, and more. Once the credits have been issued, the project information is available on the BCarbon Registry to all interested parties. BCarbon generates the carbon credits on the blockchain, where all accounting is handled as public smart contracts.

Immediate

Carbon credit projects that are immediate mean those that instantly result in the proposed result, as opposed to taking years and sometimes decades for the results to occur. Plugging wells puts an immediate end to emissions, thus have a direct impact on the environment, and immediately producing the total volume of credits for a project.

Measurable

Measurability in the carbon market refers to having CO2e quantification methods that are reliable, accurate, data driven, and repeatable. The calculations needed to fulfil the MCR protocol are industry-standard equations for determining remaining gas reserves. The calculations rely on regulatory-reported gas production numbers that are publicly available. The decline curve and leak rate model spreadsheets established by BCarbon are also publicly available and generate consistent CO2e emissions reduction results when cross-examined.

3rd-Party Validated

All carbon credit projects are required to have 3rd party validation and verification, which is a rigorous process that ensures the accuracy and eligibility of the project and claimed emissions reduction quantities. BCarbon’s MCR protocol requires that each project be validated prior to execution by a BCarbon-approved 3rd party validator and then verified once the project is complete.

Beneficial to the Community

Benefits of carbon credit project should go beyond just emissions reductions. Plugging wells has the opportunity to 1) create jobs, 2) increase the value of surrounding residential and commercial property, 3) improve human health conditions, 4) increase biodiversity, 5) remove potential liabilities to surrounding communities, and 6) improve air quality.

The long-term success of the voluntary carbon market is highly dependent on having high-quality solutions that buyers can trust. Buyers ultimately want to purchase credits from projects that represent real emissions reductions with real, measurable solutions. The BCarbon Methane Capture & Reclamation protocol was designed to bring high-quality well plug and abandonment emissions reduction projects to the market.

Guardian Plug & Abandonment is a project developer with BCarbon. If you’d like to learn more, reach out to us at info@plugandabandonment.com or check out our website at https://www.plugandabandonment.com/.