Measuring methane emissions from orphan wells for carbon credits

The voluntary carbon market (VCM) is a marketplace where individuals, organizations, and companies can voluntarily buy and sell carbon credits or offsets. The term “credit” and “offset” are frequently used interchangeably, and they represent a reduction or removal of greenhouse gas emissions from the atmosphere. The types of projects that can generate carbon offset credits include renewable energy projects, energy efficiency projects, forestry projects, methane capture and destruction projects, industrial process improvement projects, transportation projects, and agricultural and livestock projects. Each type of project must follow a specific methodology written and published by a carbon registry, which is a company that issues and retires carbon credits. Each written methodology has calculations to determine the quantity of credits each project will generate, with each credit equaling 1 ton of CO2 equivalent (CO2e) emissions reductions. For projects to qualify, they must pass the additionality test, which essentially means that the emission reductions they achieve are additional to what would have occurred in the absence of the project. In other words, the activities and outcomes must go beyond what would have happened under a “business-as-usual” case.

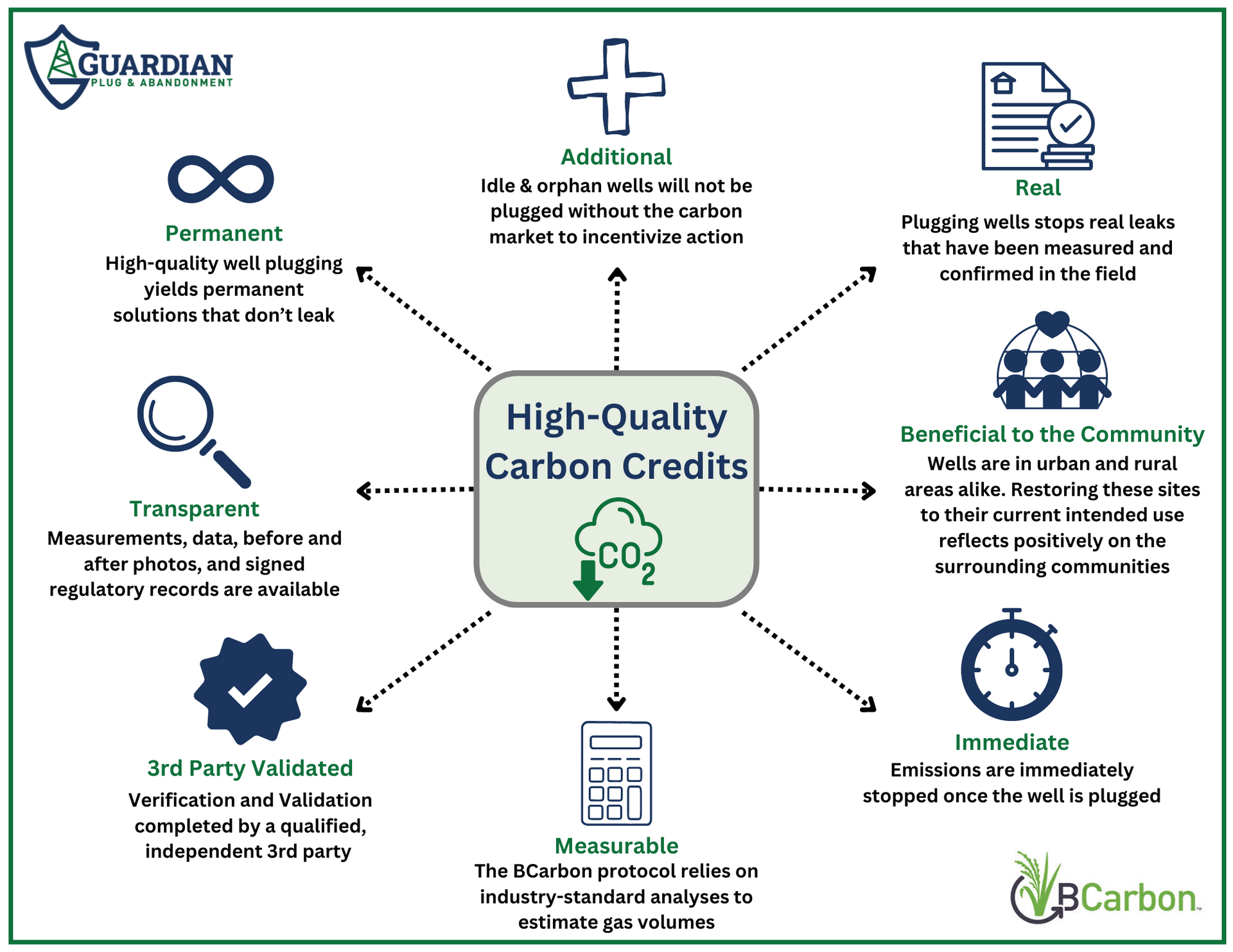

Historically, the VCM has been focused primarily on nature-based solutions, energy-efficiency projects, and renewable energy projects. However, in 2023, the carbon offset credit market met with the oil and gas industry. Two carbon registries, ACR and CarbonPath, established methodologies to generate carbon credits from plugging orphan oil and gas wells. Orphan wells are those that were drilled and operated by companies that have since gone bankrupt, leaving the responsibility to properly plug the wells to the state regulatory agency.

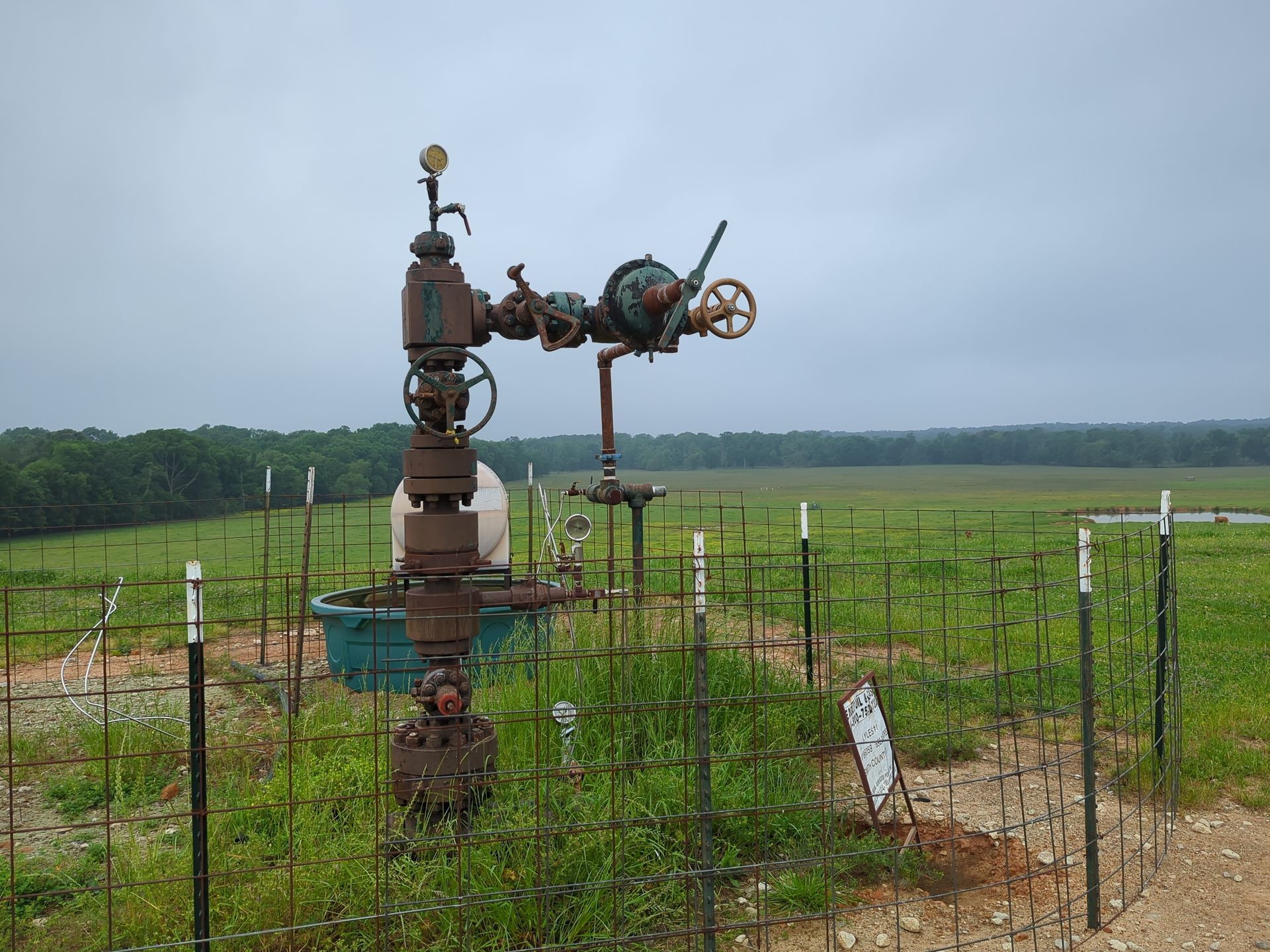

Here are how those methodologies work. By voluntarily “taking over” an orphan well from the state regulatory agency and plugging it, project developers reduce future methane (the primary component of natural gas) emissions into the atmosphere. The quantity of avoided future methane emissions determines the quantity of avoidance credits the well will generate upon plugging. Keep in mind, however, that not all orphan wells will be eligible for generating credits because not all orphan wells emit methane. Project developers must find a way to access and screen orphan wells for leaks. The steps involved to estimate the carbon credit potential of each orphan well are 1) quantifying the yearly methane emissions rate, 2) converting the methane to CO2 equivalent, and 3) multiplying by the appropriate crediting period, as described in detail below.

1. Quantify methane emissions rate

What exactly is an emissions rate? Well, it’s a volume of gas escaping from the well per unit of time. This rate can then be multiplied by the methane concentration (often between 70% and 90%) to determine the methane emissions rate. There are a variety of technologies to measure these parameters, all with unique pros and cons for use in the field in varying conditions. Some of the more popular methodologies include static and dynamic chambers, high volume samplers, vent-flow meters, and various plume modeling techniques that are often paired with optical gas imaging cameras.

At this stage in the process, project developers are simply looking for fast and reasonably reliable methods and technologies to estimate the quantity of methane leaking from the orphan well each year.

2. Methane to CO2 conversion

The methodologies to generate carbon offset credits rely on measuring the quantity of methane escaping from the well and converting it to CO2e. To convert methane to CO2e, we must look at its life span and its potency relative to CO2. Methane lives for about a decade before breaking down, whereas CO2 can last for centuries. However, methane can trap over 100 times as much heat as CO2 in the short term. The term Global Warming Potential (GWP) has been used to describe the relative impacts of methane (and other gases) over time relative to CO2. Methane’s GWP100 (warming potential relative to CO2 over a 100-year period) is approximately 25, whereas its GWP20 is about 80. Both carbon registries have adopted the GWP100 conversion rate and require that measured methane emissions rates be multiplied by 25 to convert to CO2e.

3. Crediting Period

One main difference between the methodologies established by ACR and CarbonPath is the crediting period, which is defined as the length of time for which a project is valid or the length of time a project can generate carbon credits. ACR uses a crediting period of 20 years which “reflects Enverus oilfield data that demonstrates that the average last production was 17 years ago for wells currently classified as orphan by states” according to their methodology. CarbonPath, on the other hand, ran a model with various plugging costs and calculated breakeven dollar per credit amounts. Ultimately, they decided that to incentivize taking climate action, a 50-year crediting period “strikes a balance between over crediting (representing an exceptionally long crediting period) and under crediting (with a shorter crediting period), that would raise the breakeven costs of the credits to an unactionable level,” as stated in their methodology. Thus, if a project developer registers a project with ACR, the credits generated will be multiplied by 20 years of emissions, while CarbonPath-registered projects will generate credits based on 50 years of emissions.

For project developers, estimating the quantity of carbon credits a well can generate is only the first step. They must then determine, based on their carbon credit estimates and their estimated value of the credits, which wells will be economical to plug. Then, the developer must go to the state regulatory agency and adopt the orphan well. This process involves posting bond money with the agency and registering as an oil and gas operator. Once the wells are adopted by the project developer, they can be registered as a project with CarbonPath or ACR. The project developer will then follow the methodology’s steps to quantify emissions rates.

ACR indicates that the “Hi-Flow sampler and the chamber-based methods are approved by ACR when applied correctly in the field,” but also that other techniques may apply after seeking approval. They require that an emissions rate test must be conducted for a minimum period of two hours and document a stabilized emissions rate. A second test must be conducted at least 30 days after the initial test and show an emissions rate reasonably consistent with the first measurement.

CarbonPath only requires one emissions rate measurement to be collected before plugging the well, and they do not specify exact sampling technology and procedures. They allow novel approaches to measuring methane emissions rates.

Both registries require that the emissions rate tests be thoroughly verified by an independent and qualified 3rd party at the expense of the project developer. After the 3rd party has verified and approved all measurements and the project developer has collected all necessary data, pictures, and videos of the well, the project developer is ready to plug the well(s). This will involve subcontracting a well servicing company that can enter the borehole, seal off productive zones with cement, and ultimately restore the site to background conditions, following all state regulations. After the plugging is complete, both ACR and CarbonPath require that the project developer return to the site to confirm that the methane emissions have ceased.

ACR and CarbonPath will issue the total amount of carbon credits to the project developer once the regulatory agency-signed plugging document has been received and all other verification and documentation has been completed.

The final step for a project developer is to sell the credits. ACR-generated credits can be listed for sale on ACR-approved retailers and marketplaces. CarbonPath-generated credits are listed for sale on their own website and are posted for sale at $30 each. However, project developers can enter into an agreement with a buyer and CarbonPath to sell at a different price, should they choose to do so.

These are exciting times for the oil and gas industry. With these new methodologies, the oil and gas industry will clean up old wells, reduce methane gas emissions, and contribute to positive climate action. Early adopters of this methodology will be best suited to find the most highly-emitting orphan wells and benefit the most financially from stopping these significant sources of methane emissions.

Guardian Plug & Abandonment (GPA) is a project developer for carbon projects. GPA is also a qualified measurement specialist and can quantify the carbon credits a leaking orphan well could generate with ACR and CarbonPath. Should you have questions, feel free to reach out at info@plugandabandonment.com or check out our website at https://www.plugandabandonment.com/.