Preventing Orphan Wells by Addressing Idle Wells

Within the oil and gas well plugging industry, orphan wells have captured quite a bit of attention in the last 2-3 years. This is because of two main factors – 1) Large amounts of federal funding to locate, measure, and plug orphan wells and 2) carbon credit opportunities for plugging leaking orphan wells, particularly from ACR which had their methodology published in May 2023.

Orphan Wells

But what is an orphan well and why are these funding and carbon credit opportunities focused only on orphan wells? The consensus among all state and federal regulatory agencies is that an orphan well is no longer serving its purpose and it has no known owner or operator capable of properly plugging it. With no solvent operator, the well owner becomes the regulatory agency. The United States Geological Survey (USGS) conducted a study in 2021 and identified records of more than 126,000 orphan wells (see here) and the number of undocumented orphan wells is estimated to be between 310,000 and 800,000 (see here) according to a 2021 study by the Interstate Oil & Gas Compact Commission (IOGCC), but the real tally may be much higher.

The reason they are the target of federal funding is because they are the responsibility of these government agencies. The reason ACR and the carbon industry have adopted orphan well methodologies is because of the clear additionality argument, stating that the business-as-usual case is that orphan wells are not plugged in a timely manner.

Idle Wells

The orphan well problem is large, but it is just the tip of the iceberg. Of the more than 4 million wells that have been drilled to extract oil and natural gas (see here), the EPA estimates that there are a total of 3.7 million abandoned wells (see here), which includes the orphan wells in the USGS study. Most idle wells were made idle with the hope of bringing them back to production when the economic situation improves. The reality, however, is that the majority of these wells are forgotten about. As is pointed out in this article, due to the complex and expensive process to plug wells, many operators “have simply opted to defer their [plugging] obligation by paying fees as low as a few hundred dollars per year.”

Another option for operators of low producing and idle wells is to bundle up a package of wells and sell them to smaller operators that can work on thinner profit margins. In fact, many small operators will give away their wells to avoid the plugging liability.

Outlook on the future

As is pointed out in the IOGCC study, the number of idle wells “is a concern because of the potential for the wells to deteriorate over time or become orphans.” In an effort to improve operations in the oil and gas industry, the EPA issued its “Final Rule” in early 2024, which is aimed at reducing methane emissions. Among other things, this final rule increases routine emissions monitoring requirements, increases regulation on flaring and venting gas, requires improved greenhouse gas reporting, and imposes a methane tax for excess methane emissions. While many believe this is a step in the right direction for the industry, it also puts small to medium oil and gas operators in a pinch. Many don’t have the knowledge or resources to comply with these regulations, which will cause some to go bankrupt.

When an oil and gas operator goes bankrupt, their wells become orphaned. Despite the efforts to plug orphan wells with federal funding and carbon credit motives, many experts in the industry fear that the number of orphan wells will still increase, not decrease..

Getting ahead of the problem

Plugging orphan wells will certainly help clean up the industry’s legacy issues, but that solution is treating the symptom rather than solving the ongoing issue. Fortunately for the industry, solutions are coming to prevent future orphan wells.

First is The Methane Emissions Reduction Program, which announced $350 million to 14 states to help measure methane emissions and plug marginal and idle conventional wells (see here). This is a federal program aimed at “helping well owners and operators [to] voluntarily identify and eliminate methane emissions from low-producing conventional oil and gas wells…with disproportionately high methane emissions.” A Notice of Intent to make funds available to states was announced in February 2024 and implementation by the states is expected to begin in the Fall of 2024.

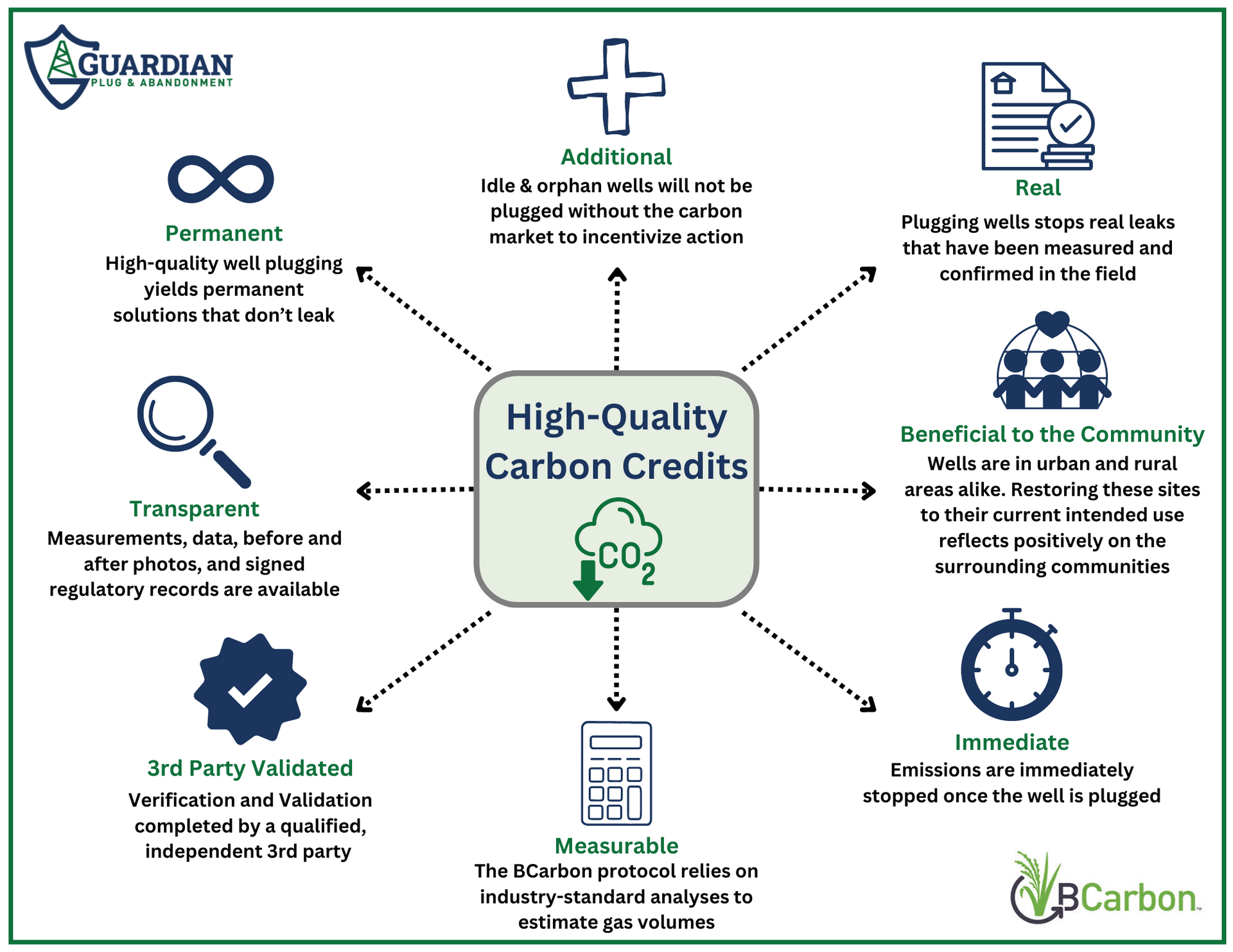

Second are expanding carbon credit methodologies. In addition to orphan well methodologies, several registries are establishing methodologies that address idle and marginal wells. Of those is BCarbon, whose methodology titled “Methane Capture & Reclamation” was released in October 2023. This methodology applies to all leaking, non-producing wells that historically produced gas, with the objective of preventing current and future methane leaks. As is stated in the methodology, “the key underlying observation is that leaking wells eventually completely exhaust the gas that is potentially available…” The quantity of carbon credits generated relies upon an industry-standard decline curve analysis of the historical gas production data combined with a leak rate model that determines the quantity of methane that would have leaked over the next 20 years (i.e. the crediting period).

Final thought

These solutions certainly won’t fix the industry overnight, but they are adding to the list of innovative solutions to help clean up legacy issues. If you’d like to learn more, reach out to Guardian Plug & Abandonment at info@plugandabandonment.com or check out our website at https://www.plugandabandonment.com/.